Figuring interest on a loan

For example if one person borrowed 100 from a bank at a compound interest rate of 10 per year for two years at the end of the first year the interest would amount to. The rate usually published by banks for saving accounts money market accounts.

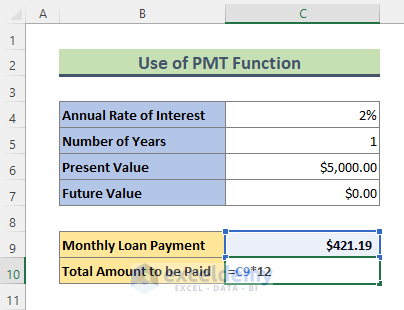

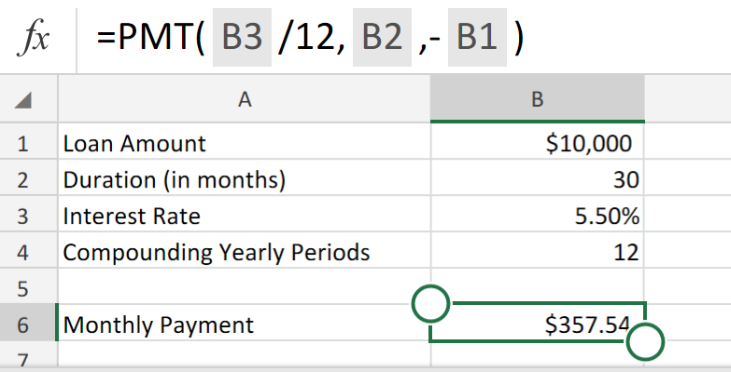

Excel Formula Calculate Payment For A Loan Exceljet

Nominal interest rate n 1 r1n - 1 r effective interest rate n number of compounding periods What is the effective interest rate.

. This does not include any down payment you are. This is the total amount you are borrowing. It can also be described alternatively.

The formula for nominal interest rate is. Some lenders ask for the origination fee upfront while most deduct the fee after approval. 100 10 110 Derek owes.

100 10 1. It typically ranges from 1 to 5 of the loan amount. For instance 10000 borrowed with a 3.

Interest rate is the amount charged by lenders to borrowers for the use of money expressed as a percentage of the principal or original amount borrowed. Bajaj Finserv Bajaj gives the option to calculate your CIBIL score online and offers a host of loans like Doctor gold home personal business auto etc. Divide your interest rate by the number of payments you make per year Multiply that number by the remaining loan balance.

100 10 10 This interest is added to the principal and the sum becomes Dereks required repayment to the bank one year later. There are three main components when determining your total loan interest. Loan interest is usually expressed in APR or annual percentage rate which includes both interest and fees.

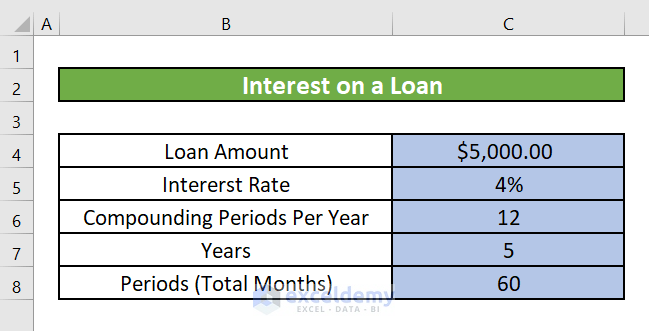

To calculate the daily compounding interest on a 10000 10 note for 90 days please allow for rounding differences. In fact figuring out how much youre paying in interest is as simple as multiplying your interest rate by your outstanding balance and dividing by 12. The interest-only period typically lasts for 7 - 10 years and the total loan term is 30 years.

Its only because lenders. For a weekly rate divide the annual. For a quarterly rate divide the annual rate by four.

The Bankrate loan payment calculator breaks down your principal balance by month and applies the interest rate you provide. Convert the percentage rate to a decimal. After the initial phase is over an interest-only loan begins amortizing and you start paying the.

To calculate the amortized rate you must do the following. Because this is a simple loan payment calculator we cover. For a daily interest rate divide the annual rate by 360 or 365 depending on your bank.

Free Interest Only Loan Calculator For Excel

Simple Loan Calculator

How To Calculate Loan Payments Using The Pmt Function In Excel Youtube

How To Calculate Gold Loan Interest In Excel 2 Ways Exceldemy

Interest On Loan Meaning Formula How To Calculate

How To Calculate Interest On A Loan In Excel 5 Methods Exceldemy

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

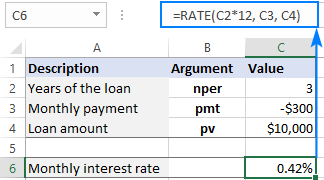

Excel Formula Calculate Interest Rate For Loan

Interest Formula Calculator Examples With Excel Template

Using Rate Function In Excel To Calculate Interest Rate

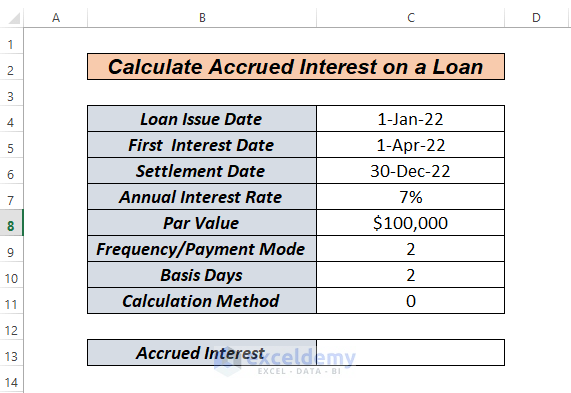

How To Calculate Accrued Interest On A Loan In Excel 3 Ways Exceldemy

Excel Formula Calculate Interest Rate For Loan Exceljet

Excel Formula Calculate Loan Interest In Given Year Exceljet

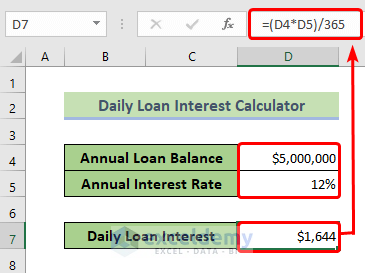

Daily Loan Interest Calculator In Excel Download For Free Exceldemy

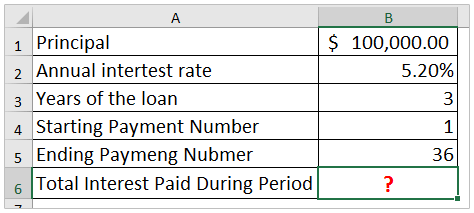

How To Calculate Total Interest Paid On A Loan In Excel

Simple Interest Loan Calculator How It Works

Advanced Loan Calculator